|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

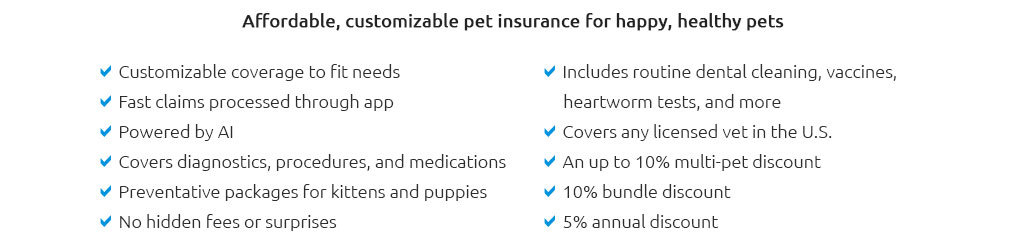

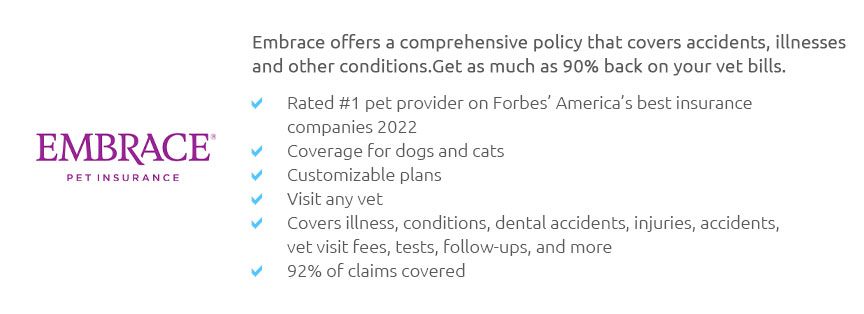

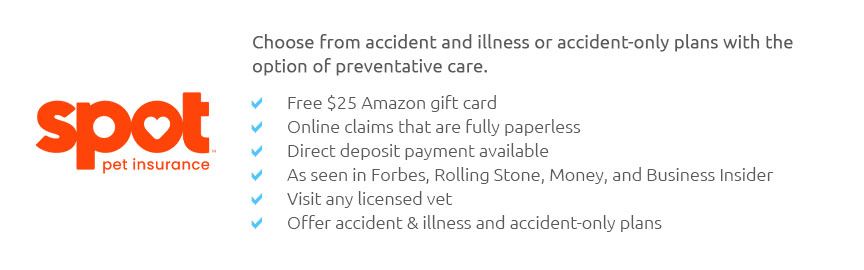

Understanding Health Insurance for Dogs: An In-depth ExplorationIn recent years, the concept of health insurance for dogs has gained significant traction among pet owners who increasingly view their canine companions as integral family members. As veterinary care advances, so too do the costs associated with maintaining the health and well-being of our furry friends. Consequently, many pet owners find themselves grappling with the decision of whether to invest in health insurance for their dogs, weighing the potential benefits against the financial commitment. This article aims to elucidate the nuances of canine health insurance, offering insights into its advantages, limitations, and best practices for selection. At its core, health insurance for dogs operates similarly to human health insurance. It is designed to mitigate the costs of veterinary care, ranging from routine check-ups and vaccinations to unforeseen illnesses and emergencies. However, unlike human health insurance, policies for dogs typically require the pet owner to pay the veterinary bill upfront, with reimbursement provided by the insurance company upon claim approval. One of the most compelling arguments in favor of dog health insurance is the peace of mind it affords pet owners. Knowing that financial constraints will not impede the provision of optimal care for one's dog is invaluable, especially in emergencies. Additionally, insurance can encourage owners to seek timely veterinary attention, potentially catching health issues in their nascent stages and thereby improving outcomes.

When selecting a health insurance plan for your dog, it is prudent to conduct extensive research, comparing various providers and seeking recommendations from trusted sources such as veterinarians or fellow pet owners. Reading reviews and scrutinizing the fine print of each policy can prevent unwelcome surprises down the line. In conclusion, while health insurance for dogs is not a one-size-fits-all solution, it offers a viable option for many pet owners seeking to safeguard their pets' health without incurring prohibitive costs. By understanding the different types of coverage available, considering personal circumstances, and carefully evaluating potential policies, dog owners can make informed decisions that best serve their canine companions' needs. Ultimately, the investment in health insurance can be seen as an expression of the commitment and love we have for our pets, ensuring they receive the best care possible throughout their lives. https://www.costco.com/pet-insurance.html

Pet medical insurance can help reduce financial stress when choosing care for your dog or cat. For a monthly premium based on your pet's age, breed, location ... https://www.metlifepetinsurance.com/dog-insurance/

With plans starting at $16 per month, dog insurance reimburses you for covered expenses on your pet's health care, helping you save money and keep tails ... https://www.petsbest.com/

Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and ...

|